Are you in considerable debt? Are you confused as to what your next step should be? 1-888-DEBT-END is here to help you. As dedicated Los Angeles bankruptcy lawyers, we can help you eliminate the burden of debt, avoid foreclosure and eviction, protect your assets, and receive a financial fresh start. We make it easy to get the help you need, with offices close to Los Angeles, Van Nuys, and Encino. If you live or work in the area and are in need of a local Los Angeles bankruptcy lawyer to help you ease the financial burden (or if you are farther away but willing to travel for a fine bankruptcy lawyer), then look no further. A Van Nuys, Encino, or Los Angeles bankruptcy lawyer in our offices can give you the experienced and dedicated legal advice and representation you need. From the moment you may be just considering bankruptcy to resolve your financial problems, all the way through the discharge of your debt (or other applicable solution), we will be there to guide and protect you, to ensure that you can obtain all of the benefits associated with seeking relief under the U.S. Bankruptcy code (if that is the appropriate solution for you). Put an expert Los Angeles bankruptcy lawyer on the case immediately.

What are the Benefits of Filing for Bankruptcy, and What Can Our Los Angeles Bankruptcy Lawyers Do for You?

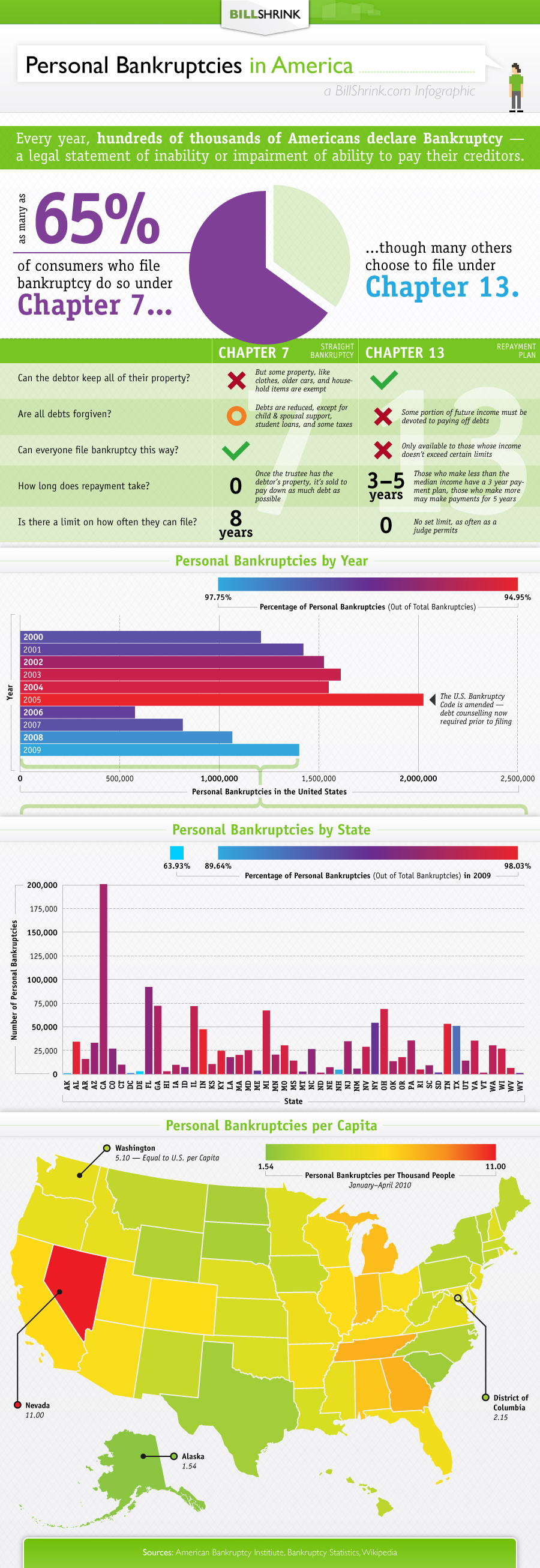

There are several advantages to filing for bankruptcy with a dedicated and experienced Los Angeles bankruptcy lawyer. Collection efforts must stop as soon as you file for bankruptcy under Chapter 7 or Chapter 13. As soon as your petition is filed, there is by law an automatic stay, which prohibits most collection activity. If a creditor continues to try to collect the debt, the creditor may be cited for contempt of court and/or ordered to pay (you) damages. The stay applies even to a loan you may have taken to buy your car. If you continue to make payments, it is unlikely that your creditor will act against you. However, if you miss payments your creditor will probably petition to have the stay lifted in order to either repossess the car or renegotiate the loan. We can advise you how best to proceed if this happens. Of course, bankruptcy is not the answer in all situations. You need a knowledgeable and ethical bankruptcy lawyer, not only to advise you about filing for bankruptcy, but also to advise you if bankruptcy is not a good option for you, and what alternatives are preferable. Dedicated debtors’ lawyers, 1-888-DEBT-END’s mission is to provide people with real debt relief. Our varied expertise and aggressively creative approach enables us to design a plan of attack that really solves our client’s unique problem or set of problems, and protects his assets—home, car, cash, income, business—whether that solution includes bankruptcy or not. There are many sources to learn about bankruptcy and its numerous benefits; learn more about the advantages (and disadvantages) of bankruptcy. There are also free public sources that may answer some of your questions.

What Is Chapter 7 Bankruptcy?

Chapter 7 Bankruptcy, often called “fresh start bankruptcy” or “straight bankruptcy,” is a liquidation proceeding. Chapter 7 bankruptcy may eliminate most kinds of unsecured debt. Some examples of unsecured debts Chapter 7 may eliminate are credit cards, medical bills, most personal loans, judgments resulting from car accidents, and deficiencies on repossessed vehicles. The main purpose of a Chapter 7 is to give a person who is hopelessly burdened with debt, a fresh start by wiping out his debts. In order to determine whether your specific debts are dischargeable via Chapter 7 bankruptcy, and whether all of your assets will be fully protected, it is imperative that you consult with an experienced Los Angeles bankruptcy lawyer. Our highly experienced bankruptcy lawyers will take the time to conduct a thorough analysis of your situation, address all your concerns, and discuss the options that best fit your personal situation. Find out more about Chapter 7 Bankruptcy or meet with a highly qualified bankruptcy lawyer today.

What Is Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy is significantly different from Chapter 7 Bankruptcy. A Chapter 13 is a reorganization of debt, allowing you to keep valuable property, like a home or a car, by repaying a portion of your debts through a Chapter 13 plan. The concept is similar to debt consolidation, but unlike most debt consolidation programs, it permits you to pay down unsecured debt or even secured debt without accruing interest (some student loans are an exception) and without having to deal with those annoying calls from debt collectors. Under a typical plan, you make monthly payments to a court-appointed bankruptcy trustee for 36 to 60 months. The amount of your required monthly payment is determined by several factors, such as the amount of your debt, your ability to repay, and the extent of your assets; but generally it is at least as much as your regular monthly payment(s) on the loan(s), plus an amount to catch up on the delinquency. Chapter 13 may be proper if you are in danger of losing your home because of money problems; if you are behind on debt payments, but could catch up if given some time; or if you have valuable property that is nonexempt, but you could pay creditors from your income over time. In a Chapter 13 case, you must have enough income to make such periodic payments and to pay your other living expenses. Once a Chapter 13 repayment plan begins, the trustee will disburse your monthly payments to your creditors. Find out more about Chapter 13 Bankruptcy or meet with a highly qualified bankruptcy lawyer today.

Why Call Us?

As a taxpayer, you’ve helped bail out the big banks (some of your creditors probably among them), so that they could remain super-wealthy. But now that you are in serious financial trouble, are those creditors willing to help you? No. Bankruptcy is the financial bailout for the little guy. If you avail yourself of it, your creditors will still be super-wealthy. You won’t be rich. But at least you’ll have a fighting chance of survival. You might have a moral duty to take this opportunity to turn your financial life around, so that you can start working, not to make the predatory rich even richer, but to give yourself and your family a decent life—so that you can stop struggling perpetually up the mountainside to the poorhouse, and start walking, on level ground, toward your fulfillment, at long last, of the American dream. You and your family deserve no less. Contact us now for a fresh start: 1-888-DEBT-END (1-888-332-8363), or simply fill out this form. In addition to the finest legal advice and representation, we offer free initial consultations; flexible appointment times; and service on an emergency basis. Let us help you.

1-888-DEBT-END

Law Offices of Richard J. Eisner

Southern California

Se habla Español